[ad_1]

The Washington, D.C. metropolitan area has one of the strongest real estate markets in the United States. With a large population, high incomes, and a well-diversified labor market, D.C. has a strong foundation for sustained economic growth. And, because the D.C. area is comprised of more than just the capital city and includes parts of Maryland, Virginia, and West Virginia, there are several sub-markets for real estate investors to consider.

Let’s go over the most important information you need to know about the Washington, D.C. real estate market.

Economic Overview

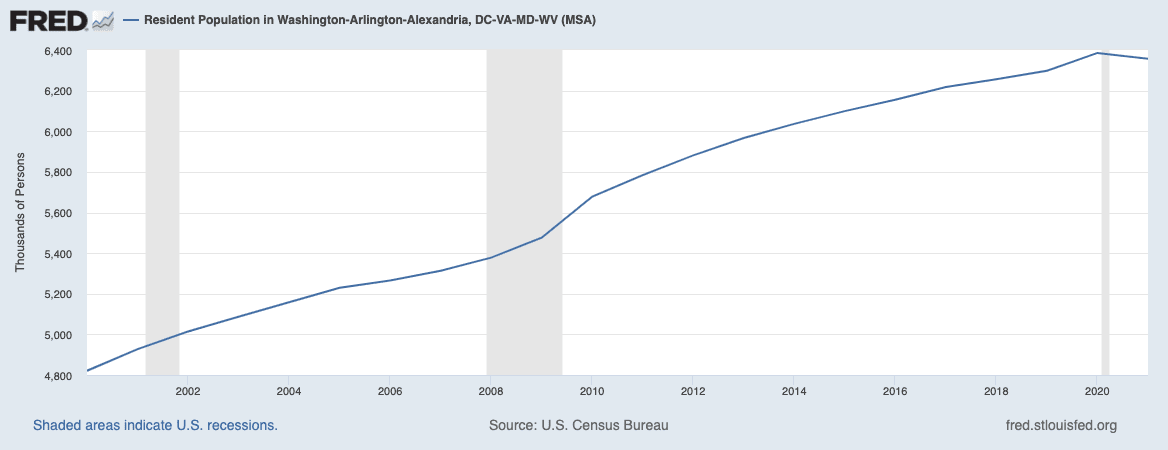

The D.C. metropolitan area is the sixth largest in the United States, with over 6,530,000 residents. It includes Washington, D.C. and parts of Virginia, Maryland, and West Virginia.

According to the U.S. Census, the D.C. area grew 14.6% between 2010 and 2020. However, according to an American Communities Survey in 2021, the region lost 0.46% of its population between 2020 and 2021. This is similar to patterns seen elsewhere in the Northeast from 2020-2022 and will be an important trend to watch.

Generally speaking, the Washington D.C. metro area has a robust and stable economy—which bodes well for long-term real estate investments.

The median household income in Washington, D.C. is $110,355, which is about 50% higher than the national average ($69,717).

This is partly because the workforce is highly educated, with more than 53% of people holding a bachelor’s degree or higher. This is 1.5 times higher than the national average of 35%.

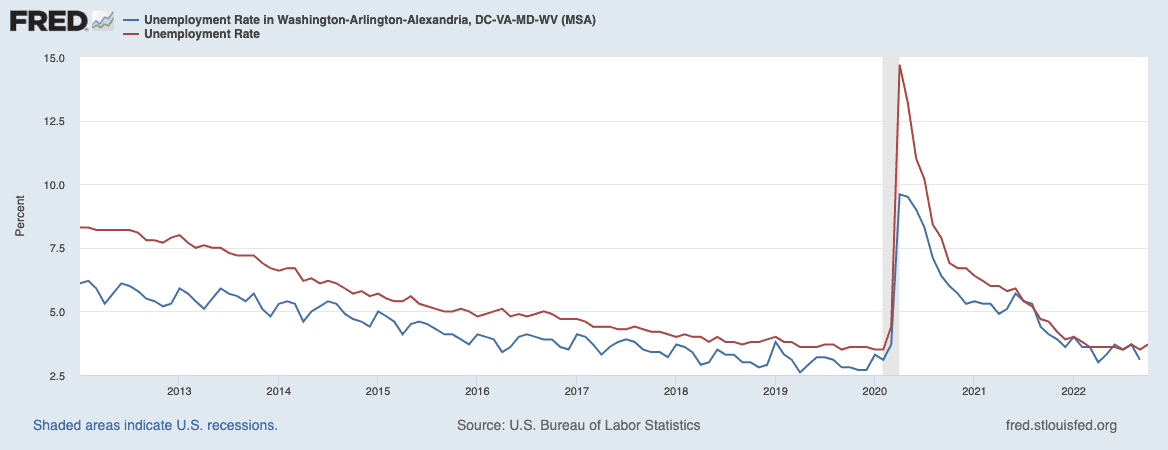

The D.C. area consistently has an unemployment rate below the national average, as seen in the chart below. As of September 2022, the unemployment rate in the D.C. metropolitan area was 3.1%, while the national average was 3.5%.

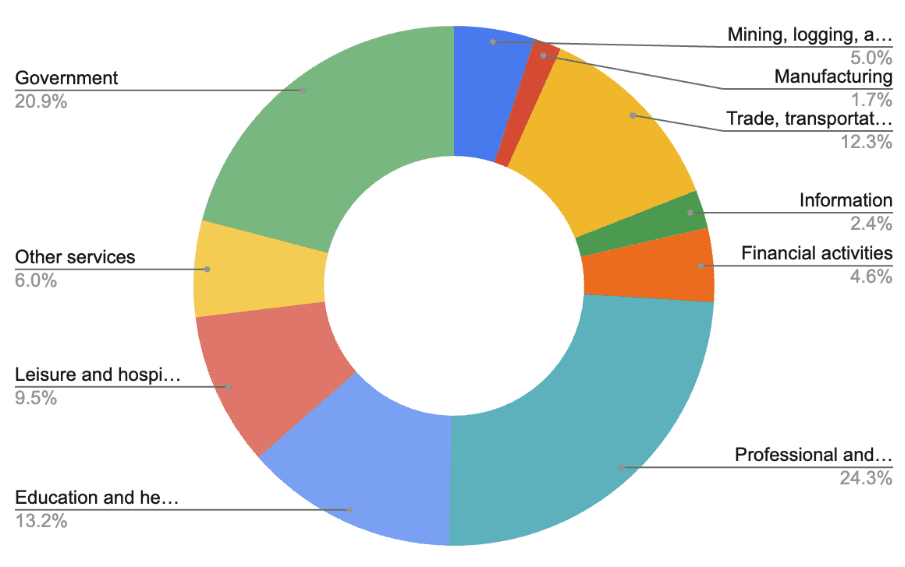

The D.C. area’s low unemployment rate is likely a product of strong private sector jobs, accompanied by over 700,000 government jobs—which tend to be more stable and recession-resistant than private sector jobs. Additionally, the D.C. area benefits from a well-diversified economy that spans many different industries, as seen in the chart below.

When selecting a market to invest in, a well-diversified economy generally means the housing and rental markets are more recession-resilient.

Property Prices

Like most of the country, the D.C. metropolitan area has seen price appreciation over the last several years but has been notably lower than the national average. Washington D.C., for example, grew 22% from September 2019 to September 2022. The national average during that period was 43%. Bethesda, Maryland, follows the same pattern as you can see below, despite being at a much higher price point.

While D.C. wasn’t one of the big “winners” in the recent price boom in the U.S., there is evidence that cities that boomed the most are most at risk of a price correction. That means that because the D.C. metro market didn’t appreciate as rapidly over the last several years, it may prove more resilient than others.

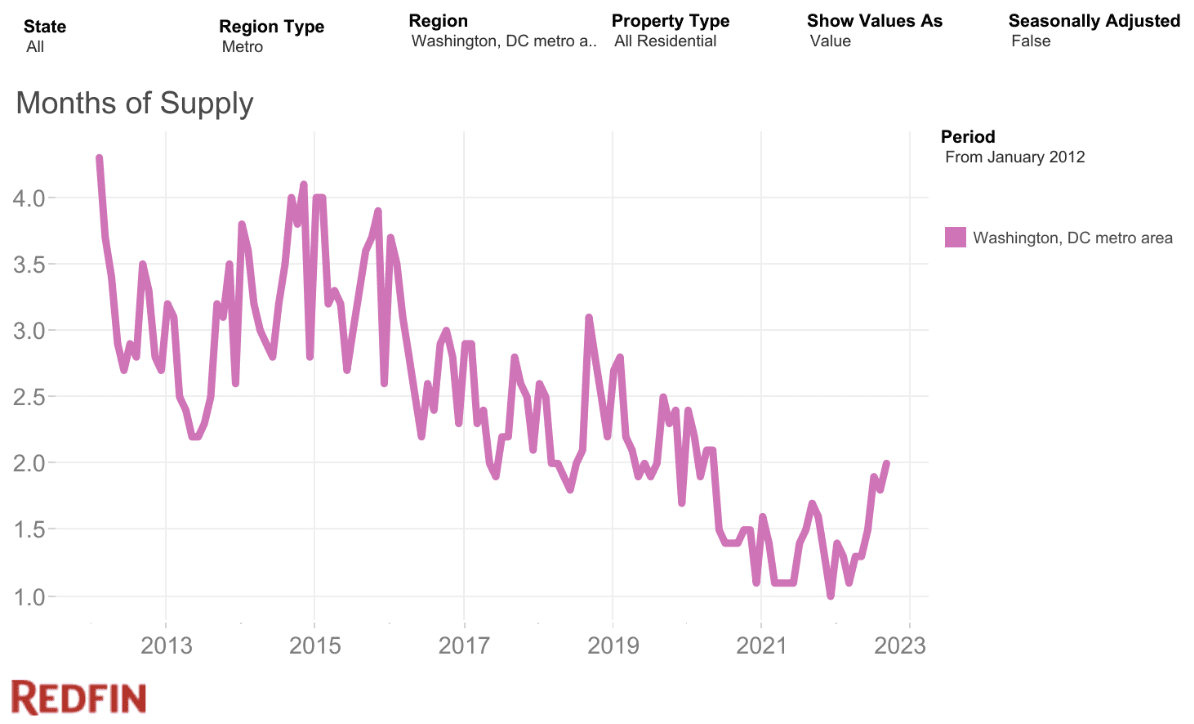

One way to measure the strength of a seller’s market is inventory. When inventory is high, it’s a buyer’s market, and prices are likely to fall. When inventory is low, it’s a seller’s market, and prices are likely going to remain stable or rise.

According to Redfin, Months of Supply (a popular way to measure inventory) is increasing in the Washington metro area but is still well below pre-pandemic levels. That’s a stark contrast to some of the fast-growing markets over the last several years like Boise, Denver, Austin, and Las Vegas. All of those markets are seeing inventory reach or even surpass pre-pandemic inventory levels, signaling a shift to a buyer’s market and increasing the chances of price declines.

Prices could still fall in the D.C. market in the coming years, but they will likely show smaller declines than the areas that boomed during the pandemic.

Rent Trends

During the first year of the pandemic, rent prices declined in the Washington D.C. metro area, as was the case for many large metro areas in the U.S.

However, beginning in early 2021, rent began to take off. In Washington, D.C., rent prices rose nearly 20% in the months between March 2022 and October 2022.

As you can see in the chart above, rents for all major cities in the metro area followed a similar pattern.

While there is no guarantee that rents will stay this high or keep growing, rents tend to be sticky, even during economic downturns. That means that cash flow prospects could be improving over the coming year throughout the D.C. area.

Find a Washington, D.C. Agent in Minutes

Connect with market expert Rob Chevez and other investor-friendly agents who can help you find, analyze, and close your next deal:

- Search “Washington, D.C.”

- Enter your investment criteria

- Select Rob Chevez or other agents you want to contact

Cash Flow Prospects

The Washington D.C. metro area has some compelling offerings for investors looking for cash-flowing markets.

One of the best ways to estimate cash flow at a high level is to look at an area’s rent-to-price ratio (RTP). Generally speaking, the higher the RTP, the better. Anything with an RTP close to 1% is considered a great area for cash flow, but it’s not an end-all, be-all rule.

Remember that these are just averages when you check out the cash flow map below. So by rule, there are individual deals in each of these ZIP codes that will offer better cash flow than the average, as well as deals that will be worse.

This map aims to help you understand which areas of the Washington D.C. area have the highest probability of a turnkey cash-flowing deal.

How To Start Investing In D.C.

As you can tell, Washington, D.C. and its surrounding metro is a phenomenal place to buy real estate.

To start investing in Washington, D.C., partner with a local investor-friendly real estate agent like Rob Chevez, who can help you find, analyze, and close the right deal.

Here’s how to Contact Rob on Agent Finder. It’s easy:

- Search “Washington, D.C.”

- Enter your investment criteria

- Select Rob Chevez or other agents you want to contact

Rob helps investors build wealth and win at the game of real estate. He leads a Top 100 KW Real Estate Team in the World, is the founder of the GRID Investor Network, has earned wealth creation and preservation certificates, and is an experienced buy-and-hold investor.

Find an Agent in Minutes

Match with an investor-friendly real estate agent who can help you find, analyze, and close your next deal.

- Streamline your search.

- Tap into a trusted network.

- Leverage market and strategy expertise.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

[ad_2]

Source link