[ad_1]

After a brutal year in 2022, the S&P 500 (SPY) ripped higher to start the year-only to give much of the gains back. Using a steady hand to steer through the daily volatility is still a very viable strategy. 2023 is shaping up as a stock pickers market. A simple system of taking profitable bullish positions in good stocks AND at the same time taking bearish positions in bad stocks makes more sense than ever. This type of balanced approach will likely continue to outperform in what looks likely to be a difficult 2023. Read on below to find out more.

Options. Implied Volatility. Many traders’ eyes glaze over attempting to comprehend what is thought to be something way too difficult to ever understand.

In reality, though, the concepts that comprise option trading are easier to understand than you think.

A walk through of what I consider the most important concept, implied volatility (IV), will help prove this to you.

The most widely followed measure of implied volatility is the CBOE Volatility Index (VIX). It measures a 30-day implied volatility for the S&P 500 Index.

Many of you are likely familiar with the VIX from hearing it discussed on the major financial news networks. In fact, I talk about the VIX on a weekly basis on CBOE-TV “Vol 411”.

People look at the S&P 500 as a benchmark for how stock prices are generally doing. In a similar vein, option traders look at the VIX as a benchmark of how option prices are doing.

A higher VIX means more expensive options. A lower VIX means option prices are cheaper. So implied volatility is just a fancy way to say ”the price of the option”.

Implied volatility can be thought of the same way we think of insurance premiums:

- Safe and steady drivers have lower car insurance premiums. Safe, steady, and lower volatility stocks have lower option premiums.

- Crazy and reckless drivers have much higher premiums. Wilder, higher volatility stocks carry much higher option premiums.

So it’s no surprise that option prices are referred to as option premiums and that many portfolio managers will buy downside puts as insurance to protect their portfolios from lower prices.

There are six components that are used to price options:

- Stock Price

- Strike Price

- Expiration date

- Current Interest Rate

- Dividends (if any)

- Implied Volatility (IV)

The first five are known. You can look at your trading screen and see the stock price, strike price, days to expiration.

Interest rates and dividends are easily found by doing a google search. The only unknown is implied volatility.

As said earlier, implied volatility is simply the price of an option. No need to do the fancy math or the calculations shown below to understand IV.

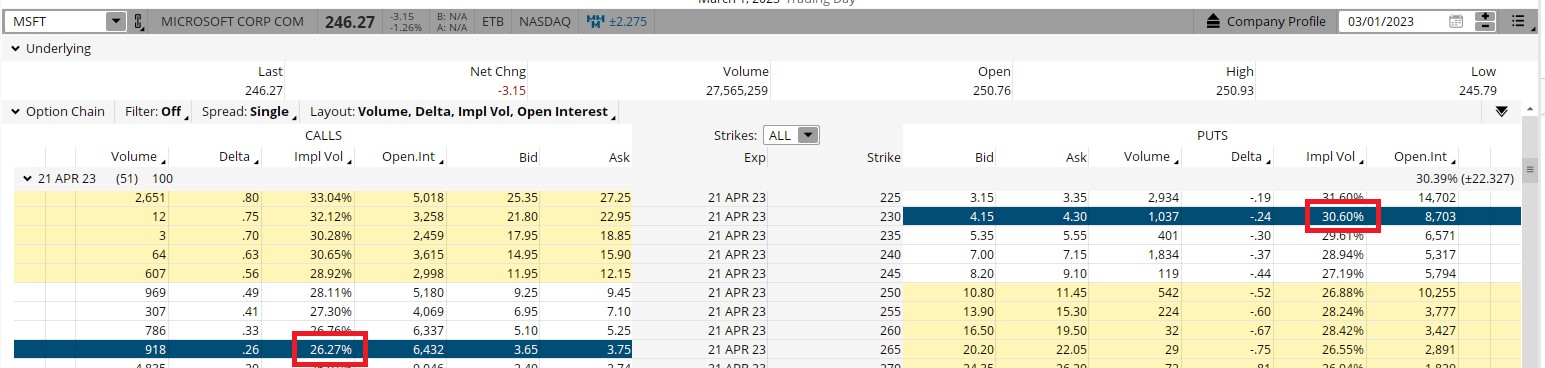

Implied volatility is called implied because it is the volatility input needed to match the price of the option to the price it is currently trading. A look at Microsoft (MSFT) options shows the implied volatility for the different strike prices.

Note how different strikes of the same expiration date – April 21 in this instance- have different implied volatilities. This is called the option skew.

An important takeaway is that out-of-the-money puts almost always trade at a higher level of implied volatility compared to similar out-of-the-money calls.

The MSFT $230 puts are priced at a 30.60 IV, while the $265 calls are priced much lower at a 26.27 IV as shown in red.

Both options closed about $17.50 points out-of-the money. Out-of-the money refers to the difference between where the stock is trading and the strike price.

Puts are out-of-the money if the strike price is below the current stock price. Calls are out-of-the money if the strike price is above the current stock price.

In this instance, the $230 puts were $17.27 points below the closing price of Microsoft ($246.27-$230)-or out-of-the money by that amount. The $265 calls were out-of-the money by $17.73 points.

The main reason for this difference in IV is the fact that stocks tend to drop more quickly than they rise. So downside puts are more valuable than upside calls.

Implied volatility tends to be much higher in front of earnings and other corporate events. This makes sense since a potentially big move in the stock price is looming.

Implied volatility usually falls following the earnings release or company announcement as the unknown becomes known.

Having a better understanding that high implied volatility means higher option prices can be vital when considering potential trades. Paying a higher option price means you need a bigger move in the stock to justify the trade.

In my POWR Options service I always do an in-depth implied volatility analysis, along with using the POWR Ratings and technical analysis as part of the idea generation process.

It is just as vital for individual traders to always consider levels of implied volatility when considering their trades as well.

Implied Volatility as a Market Timing Tool

Implied volatility can be used to identify potential turning points in the market. This is especially true when implied volatility spikes to extremes.

The charts below shows the VIX on the top and the S&P 500 (SPY) on the bottom. Note how the previous spikes in VIX (highlighted in blue) ultimately signaled significant short-term bottoms in the S&P 500.

Long periods of low levels in the VIX are a sign of complacency, which usually are a reliable indicator of short-term market tops, as seen in purple. The most recent sell signal was a sign of that.

The old Warren Buffett adage, to be “fearful when others are greedy and greedy when others are fearful,” applies perfectly to this VIX market timing methodology.

Trading, as we know, is all about probability, not certainty. Understanding and using implied volatility to put those probabilities in your favor can be a valuable addition to your trading toolbox. In POWR Options it is one of the most important tools we use.

What To Do Next?

If you’re looking for the best options trades for today’s market, you should definitely check out this key presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

Using this simple but powerful strategy I have delivered a market beating +55.24% return, since November 2021, while most investors have been mired in heavy losses.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

Here’s to good trading!

Tim Biggam

Editor, POWR Options Newsletter

SPY shares rose $0.24 (+0.06%) in after-hours trading Friday. Year-to-date, SPY has gained 5.69%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network “Morning Trade Live”. His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader.

Tim is the editor of the POWR Options newsletter. Learn more about Tim’s background, along with links to his most recent articles.

The post #1 Rule for Successful Options Trading appeared first on StockNews.com

[ad_2]

Source link