[ad_1]

Bottom line: The US Department of Commerce has amended the Export Administration Regulations and added 37 entities to the Entity List, which describes all the foreign organizations that US companies can’t do business with. Most of the blacklisted entities are from China, including the two most influential: Loongson Technology and Inspur Group Co. Also included are various state institutions, national centers for research, equipment manufacturers, and private software companies.

About half of the targeted entities are being punished for contributing to ballistic and nuclear missile programs in China and its allied states. Most of the remaining entities, including Loongson and Inspur, are accused of acquiring American technologies on behalf of the People’s Liberation Army. China confirmed that its army was using Loongson CPUs when it banned their export to Russia last year to preserve its own supply.

Entities on the Entity List are prohibited from purchasing or licensing American technologies, even indirectly. For example, Loongson can’t have its CPUs manufactured by American equipment, ruling out most foundries with modern nodes. Companies can apply to the Bureau of Industry and Security for a license to sell their products to an entity on the list but under the presumption of denial, i.e., their chances aren’t good.

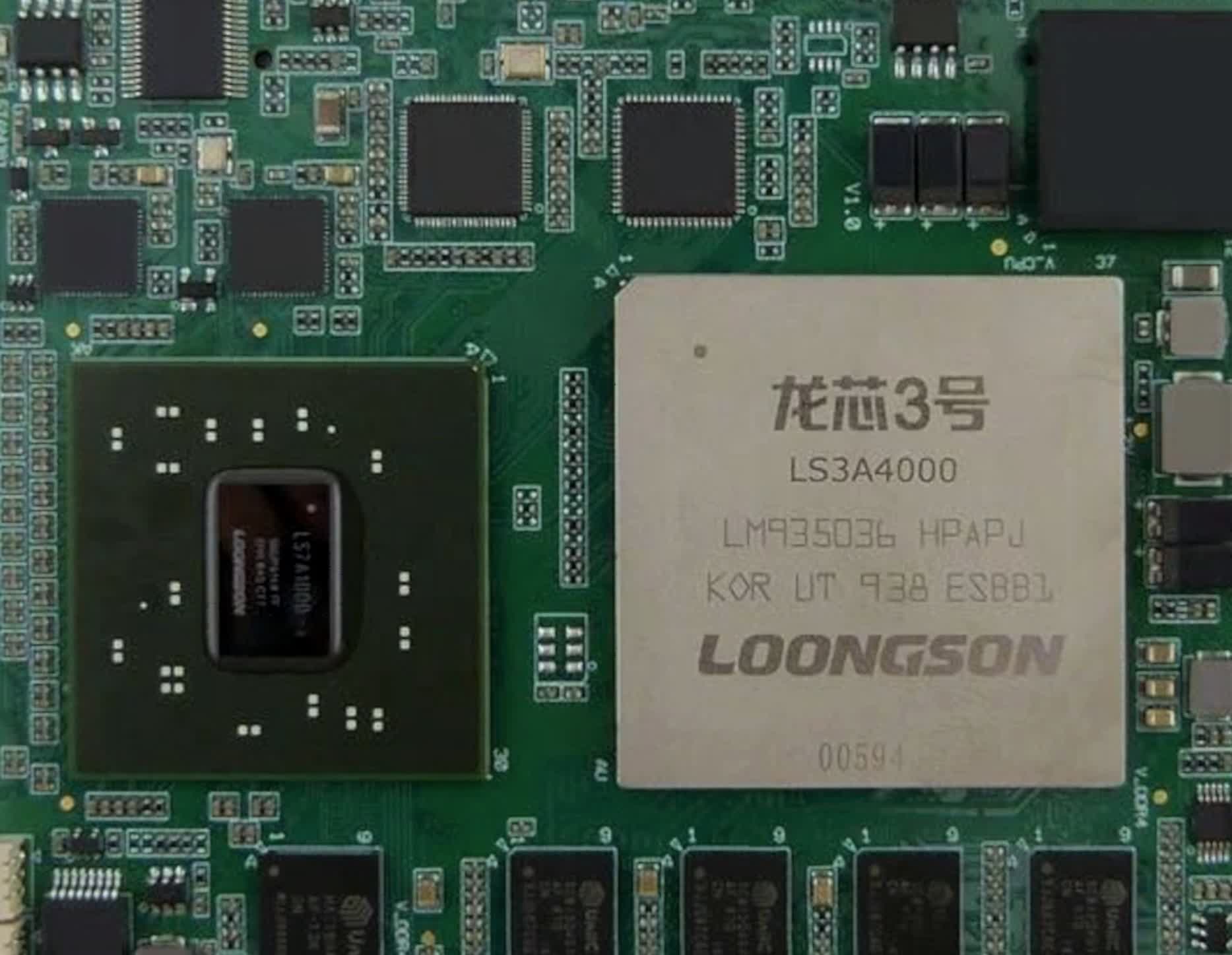

Loongson has a small line of CPUs manufactured on the 12 nm node with comparable performance to AMD and Intel CPUs from a few generations ago. However, they’re quite different under the hood and implement a proprietary ISA (instruction set architecture) called LoongArch that reduces their dependency on foreign licenses. They’re manufactured by the state-owned SMIC. Given that it’s unlikely to be granted a license, SMIC risks losing its American licenses and customers, including Broadcom, Qualcomm, and Texas Instruments, if it continues working with Loongson.

Inspur is the third-largest server provider in the world, capturing 10% of the global market. It now has its fingers in all the popular pies, including artificial intelligence, data analysis, and cloud computing and storage. It was already struggling after the US enacted a policy last September that made it difficult for Chinese companies to purchase the latest hardware from American producers, specifically AMD, Intel, and Nvidia. It’s now at risk of being cut off from motherboards, power supplies, SSDs, microcontrollers, and all of the rest of the common computer components.

We reported last week that Chinese companies had been stockpiling chipmaking equipment for the last few months in anticipation of these, and future, restrictions on their industry. This is only the latest in a succession of strikes against China’s tech industry that started with Huawei four years ago and shows no sign of slowing down.

Masthead: Louis Reed

[ad_2]

Source link