[ad_1]

Back in March and again in August, I noted that “We are undoubtedly reaching the limits of affordability for Americans,” which should “cool the real estate market” and likely “cause a correction” but without the unpleasantness of a crash.

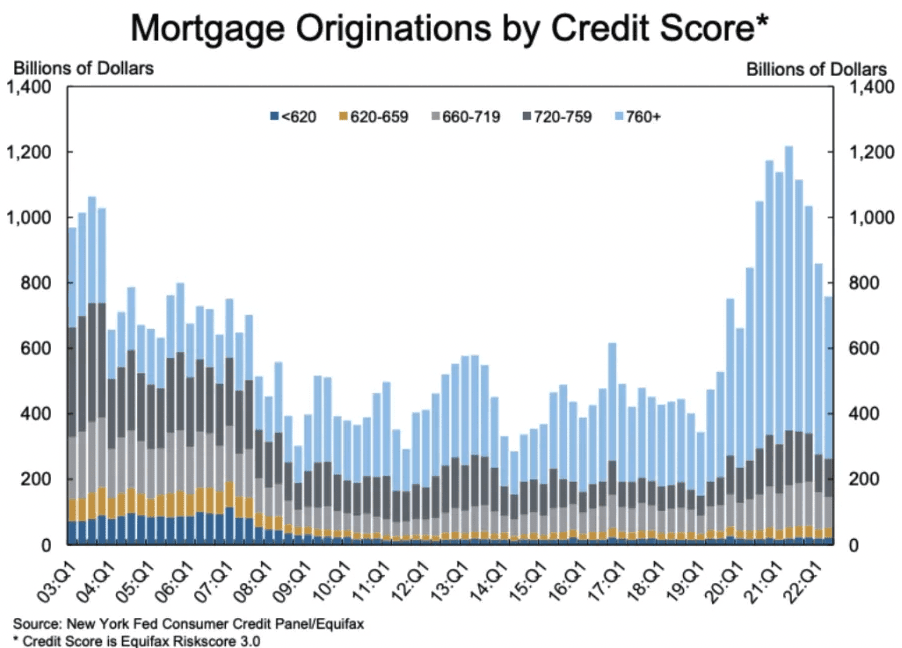

This, in my humble judgment, is still the case as the real estate market is—unlike in 2008—buoyed by much more qualified buyers with substantially more equity in their homes and long-term, low-interest, fixed debt versus the teaser rates of the early to mid-aughts. A chart of mortgage originations by credit score should drive that point home.

However, I was clearly wrong about one thing. I didn’t believe there was sufficient “political will” to really tackle inflation. That still may be true as the Fed could quickly abandon its current course. But given the litany of rate increases and the signals of more to come, it would appear that high-interest rates will be with us for quite some time.

Indeed, the 3% mortgage I got on my personal residence last year would be more than twice that now. As Dave Meyer put it, the Fed has made it clear that they want a housing correction to take place to reduce inflation and address near-historic levels of unaffordability.

So, where does that leave us now?

A Housing Correction and the “Sellers Strike”

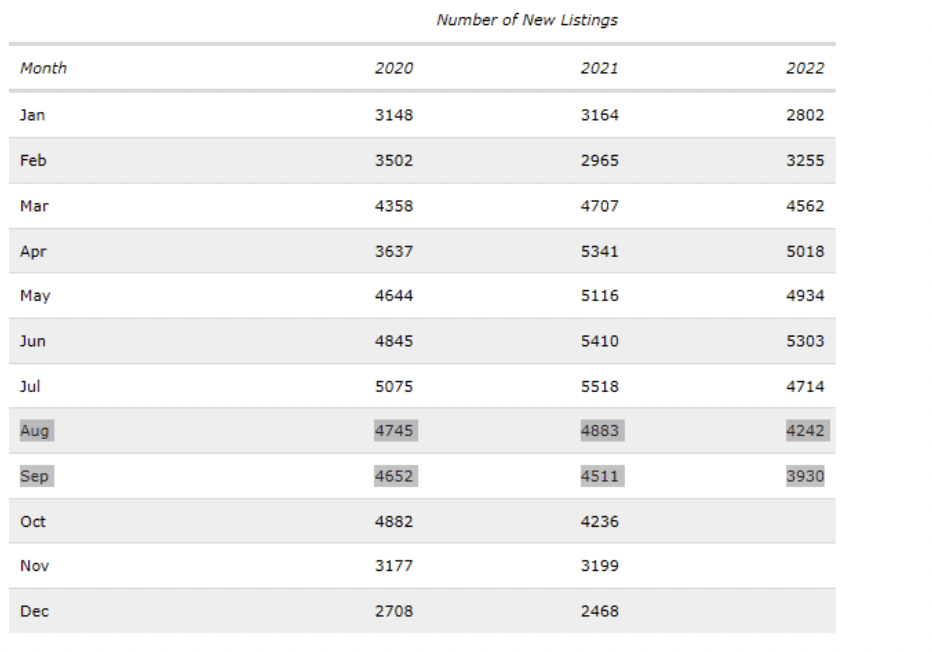

This is what the number of new listings looks like in the Kansas City Metro Area, where I live:

New listings in September 2022 were down almost 600 from 2021, a 12.9% decrease. They were down a full 15.5% from 2020.

Thus, despite the rate increases, inventory only crept up from 1.5 to 1.7 months in September 2022. A balanced market is six months, so this is still considered a “seller’s market.” (Although I would argue with this, given how odd the current market is.)

It’s important to look at year-over-year (YoY) comparisons here as new listings follow a cyclical pattern and always fall off during the winter. For instance, the year-over-year trend for new listings nationally fell 23.6% YoY in October.

However, homes for sale are still up 5% from last October. This increase in inventory came in large part due to fewer sales and nearly 20% of buyers backing out of signed contracts. There are also some rather amusing headlines, such as “average sale-to-list-price ratio fell to 99% in September.” It had been a shade over 103%, which is, well, not exactly typical.

Overall, this is what Bill McBride calls “the sellers strike.” There simply aren’t very many good reasons for homeowners to try and sell their house right now. So, they don’t. Therefore, we should expect this trend to accelerate and be with us for quite some time.

Americans Are Staying Put

Of late, Americans have been substantially less likely to move than they had in years past. As The Hill noted in 2021:

“New data from the U.S. Census Bureau shows just 8.4 percent of Americans live in a different house than they lived in a year ago. That is the lowest rate of movement that the bureau has recorded at any time since 1948.

“That share means that about 27.1 million people moved homes in the last year, also the lowest ever recorded.”

Even before the pandemic, record lows were being set. The reasons for this are many, including an aging population, fewer children, and, of course, housing being so expensive.

In that same vein, the number of new home listings was also falling even before prices went through the roof and the recent interest rate hikes.

The average duration of homeownership went up to eight years, an increase of “about three years over the last decade,” according to The Zebra. The change in the median length of stay is even more dramatic. It has almost tripled from about five years in 1985 to 13.2 years in 2021.

If you think about it, it makes sense. Why move, particularly now?

Most homeowners (approximately 95%) have 30-year, fixed-rate mortgages. Anyone who took out a loan in the last five years has a rate below at least 4%. Why would you ever voluntarily pay off such a loan?

And as we have seen, fewer and fewer people are.

Interestingly enough, the same thing is happening in the rental market.

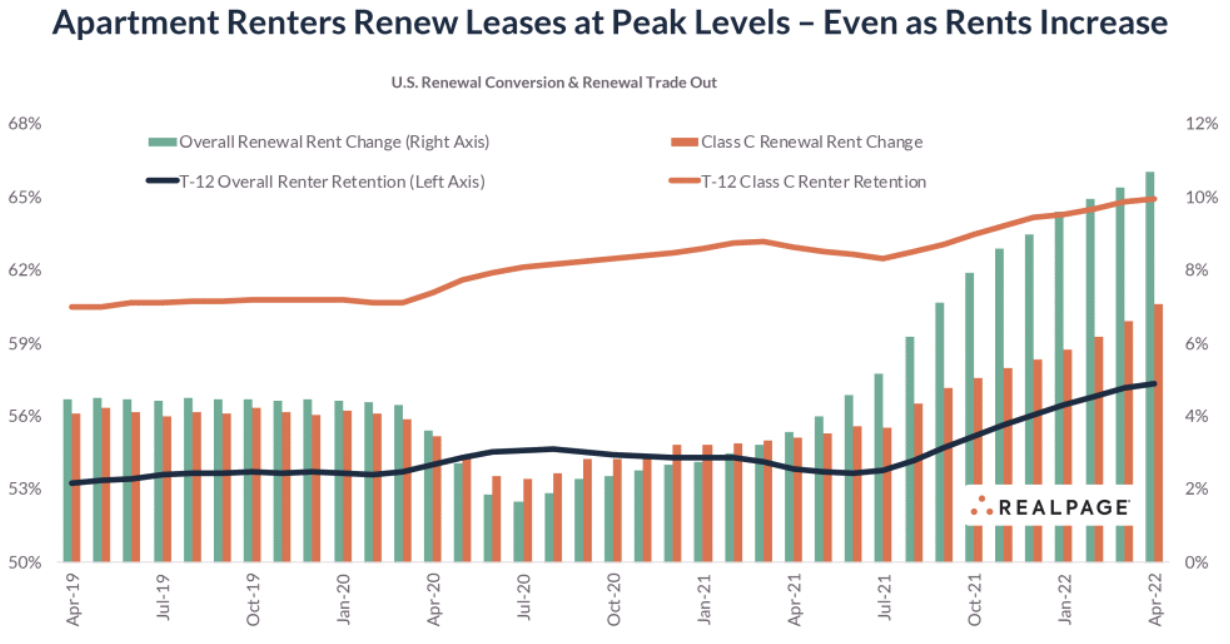

Tenants are renewing their leases at a record level. In April of 2022, over 65% of tenants renewed their lease versus just over 56% in 2019, according to RealPage.

This also makes sense if you understand that the giant rent increases you hear about are just for new listings. For example, back in April, when the year-over-year rent increase for new listings was 16.9%, NPR found that the average tenant was only paying 4.8% more than the year before.

The reason is that very few landlords are willing to raise rent all the way to market on current tenants. Increasing the rent much more than 5% often inspires a tenant to leave just out of spite. So, if rent is (or at least was) going up 16.9% elsewhere but only 4.8% where you are, you’re likely to stay put.

So, is the United States—birthed in a fight against monarchy and entrenched aristocracy—regressing to a realm of feudal serfs bound to the land they currently inhabit?

Well, for the time being, sort of.

Opportunities In This Very Odd Market

The Homeowner That Rents

The “sellers strike” has and will continue to buoy the housing market as long as interest rates are high (at least by post-2008 crash standards). At the same time, it is likely cooling the rental market, and I suspect many homeowners who need to relocate are choosing to rent out their homes instead of selling them, and thus the volume of rentals is increasing.

Asking rents are starting to moderate. From a high year-over-year increase of 18% in April, they are now down to just 7.4% in November and only 1.2% higher than in October.

Even still, rents are quite a bit higher than they were even a few years ago, so continuing to hold rentals as a landlord should do fine in the near term.

Furthermore, for any homeowner out there who needs to move for a job relocation or whatnot, the best play is likely to rent your current home and then find a rental where you are moving to. After all, the softening rental market will help you in finding a rental equally as much as it hurts you in renting out your current residence.

And again, why pay off your 2.65% loan on your current home to get a 6.95% loan on a new one? That is not a particularly lucrative form of arbitrage right there.

I suspect the “homeowner who rents” will become much more common in the next year or so. And while such ideas may come naturally to the readership of BiggerPockets, they likely won’t naturally occur to the “normal” homeowner despite it being in their best financial interest. So please make sure to enlighten others about their options in this high (by recent standards) interest rate environment.

Subject To

The next major opportunity is a bit more rife with uncertainty, and this is the infamous “subject to” strategy.

“Subject to” just means that the purchase is “subject to the existing financing.” Effectively, the buyer assumes an unassumable loan.

Or in other words, the buyer takes the deed to the property and makes the loan payments, but the loan stays in the seller’s name.

The advantages to the buyer, in this case, are obvious. If you can “assume” a loan at 2.85% on a property, how much does the purchase price even matter?

There are several problems, though. First of all, you need to seriously build rapport with the seller in order for them to trust you to pay their mortgage on a house they no longer own. After all, if you don’t make the payments, it’s the seller’s credit that will take the hit.

Secondly, virtually every mortgage and deed of trust has a “due on sales” clause. This allows a bank to call the loan due the moment the property transfers ownership. In the past, banks have very rarely done so. It might be different this time around, though. Would a bank keep a 3% mortgage on its books when the going rate is over 6%?

All we can really say is that we don’t know for sure. If you do employ this strategy, you should have a plan B to refinance or sell the property if the bank does elect to call the loan due.

Lastly, holding a mortgage without the corresponding property will seriously affect a seller’s debt-to-income ratio and make it very difficult to buy a new property. At the same time, as a subject to buyer, I would never want to pay off any mortgage made between 2018 and the middle of 2022. Thus, there could be a long-term conflict and even an ethical issue that wasn’t present so much when subject to’s first became popular in the early 2010s.

Even though you may not have a fiduciary duty to the seller, you should be very clear about what the ramifications could be with the seller upfront. I would recommend even coming to an agreement or something to that effect about how long you will keep that mortgage in place before refinancing or selling.

Conclusion

As long as rates stay high, the “sellers strike” should continue. Expect very low rates of new listings for the foreseeable future. The real estate market will soften and decline a bit, but without a strong incentive to sell, the sellers strike, amongst other factors, should keep it afloat.

Find an Agent in Minutes

Match with an investor-friendly real estate agent who can help you find, analyze, and close your next deal.

- Streamline your search.

- Tap into a trusted network.

- Leverage market and strategy expertise.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

[ad_2]

Source link