[ad_1]

The last year or so has been challenging for investors and savers alike. With inflation raging and many of the major markets in correction territory, it’s been difficult to find a safe place to park cash. Bond yields have been below the rate of inflation, and savings accounts have offered pathetic interest rates. Any money held in cash or bonds has been losing spending power against inflation. For real estate investors who often need time to save up cash between purchases, this can be a problem.

Luckily, it looks like things are starting to change. One silver lining of recent rate hikes is that as the Fed raises their federal funds rate, bond yields and the interest rate paid on money market and savings accounts tend to rise. This is exactly what we’re seeing. These low-risk assets now offer the potential to earn a real (inflation-adjusted) return.

Bond yields have fluctuated between 3.5% and 4% for the last several months. According to Bankrate, high-yield savings and money market accounts are now offering between 3.3% – 4.3% as of this writing.

Real vs. Nominal Returns

Earning 3.5 – 4% is a decent rate of return for a low-risk asset, but that nominal (not inflation-adjusted) yield doesn’t factor in inflation. To truly understand if these assets are a good option for investors, we need to look at the “real” rate of return. In this context, “real” means inflation-adjusted returns. For example, if inflation is 7%, and the nominal rate of return on a savings account is 4%, then your “real” return is actually -3% (4% – 7% = -3%).

With the most recent inflation rate registering a 6.5% year-over-year growth rate, it may seem like real returns on bonds and savings rates are still negative — but that may not be the case. When you read about the Consumer Price Index (CPI), being up 6.5%, that is a backward-looking measurement. It means that prices grew 6.5% from December 2021 to December 2022. It doesn’t tell us anything about what will happen in the coming year.

Inflation is Cooling

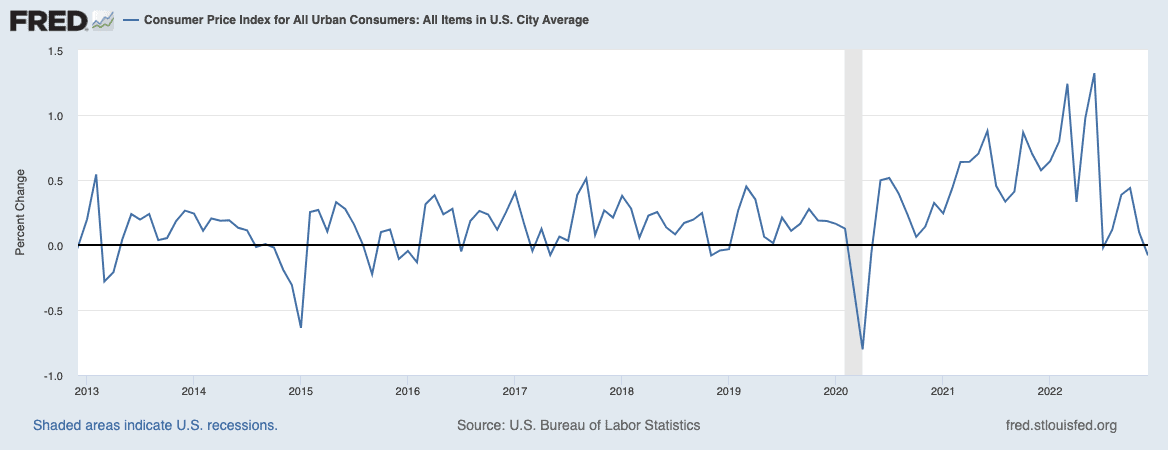

Of course, we don’t know what will happen in the coming year, but looking at the month-over-month CPI increases rather than year-over-year is helpful. Month-over-month data gives us a better idea of what’s happened recently and clearly shows a cooling of inflation.

Inflation grew consistently from 0.5% to 1.3% per month in the first half of 2022. This is, of course, incredibly high. Yet, the most recent reading shows monthly inflation actually declined by 0.1%. If inflation stays relatively flat (as it has the last few months), the year-over-year reading will be below 1% — well under the Fed’s target. Compared to a 3.5% interest rate on a high-yield savings account, you’d be making about 2-3% on your money.

But, assuming a flat monthly pace going forward is overly optimistic. Instead, let’s average the last couple of months. If we go back to July 2022, when inflation started to cool, the average monthly inflation rate over those five months was 0.16%. Extrapolate that out for a year, and at the end of 2023, we’ll see a year-over-year inflation rate of around 1.9%. This means you’d still earn a real (inflation-adjusted) return of about 1.7% if your money was held in a high-yield savings account.

Even if you believe inflation will move higher on a monthly basis, say to 0.3%/month over the coming year, that is an annual rate of inflation of 3.9%, which is above the Fed’s target of 2%. It would be about even with the rate of return on a bond or money market account.

Saving Makes More Sense Now Than Before

Of course, the real returns we’re talking about are not huge and certainly won’t build long-term wealth. But, I think this represents an important strategic consideration for investors. For the first time in more than a year, investors have a safe place to park cash where they can at least preserve their spending power, if not modestly grow. To me, this is crucially important in a complex market like the one we’re in.

Over the last year, I’ve felt a lot of urgency to invest my money in something to avoid my cash losing value to inflation. I wasn’t making bad decisions just to hedge inflation, but it felt like a constant scramble to keep up with inflation. Now, I can earn a modest real return on my cash, which allows me to be patient, and wait for the best opportunities.

Personally, I am still looking to invest in real estate right now. I believe there are going to be interesting opportunities in this correcting market, but taking advantage of them takes patience and diligence. You can’t buy just anything right now. Having a solid place to park cash gives you the ability to earn a real return while looking for the right long-term investments. This is what I intend to do. Hold some dry powder in a high-yield account and be opportunistic with my real estate investments. It’s an approach I’d recommend other investors consider as well.

Final Thoughts

It’s important to note that not all savings accounts are the same. According to my research, the biggest banks in the U.S., like Chase, Bank of America, and Wells Fargo, are still offering awful interest rates of around 0% – 0.5%, well below the rate of inflation. Other banks, like Barclays, Ally, and Marcus, offer between 3.5 and 4%.

So if you are interested in parking money in a high-yield account, do your due diligence and find a reasonable rate from a reputable bank. There are plenty of resources online that offer comparisons and reviews.

What’s your plan for the next few months? Are you still looking to invest? How are you preserving your spending power as you wait for your next real estate investment?

Run Your Numbers Like a Pro!

Deal analysis is one of the first and most critical steps of real estate investing. Maximize your confidence in each deal with this first-ever ultimate guide to deal analysis. Real Estate by the Numbers makes real estate math easy, and makes real estate success inevitable.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

[ad_2]

Source link