[ad_1]

Another day, another contradictory economic data point. For the last several months, the U.S. economy has been throwing off confusing and often conflicting signals about what is to come. Some indicators show that the U.S. economy is performing relatively well, while others are flashing ominous signs of a recession. So which is it? Is the U.S. heading towards a recession in 2023, or can the Federal Reserve actually pull off the “soft landing” it has been aiming for?

For most of the last year, I have been firmly in the “there will be a recession” camp, and I haven’t necessarily changed my mind, but it’s impossible to ignore some of the better-than-expected economic data that has been released recently. I am not saying a soft landing will happen, but I do think it’s more likely now than it was just a few months ago. Below, I will provide evidence for and against a recession, and you can decide for yourself what you think will happen.

The Case for a Recession

Rising interest rates

Any conversation about a recession has to start with the Fed’s actions to raise interest rates. Since March, the federal funds rate has risen from near zero, to about 4.5%, in an effort to combat rampant inflation. Rising interest rates make it more expensive to borrow, which can reduce borrowing, spending, and investment. It can take months, or even years, for the economic cooling effects of rising rates to take effect, and it’s very likely we have not fully felt the impact of rate hikes that happened months ago—let alone the fact that they are still going on.

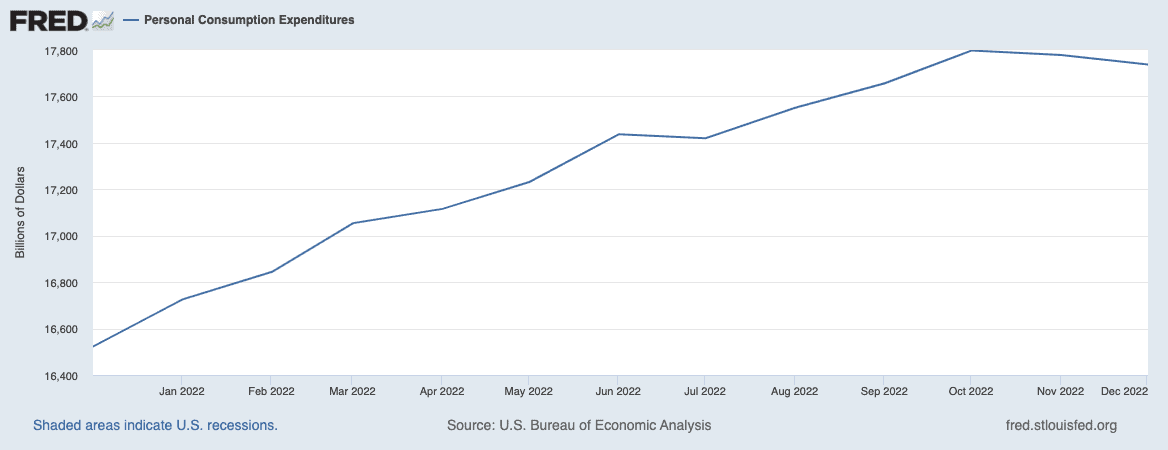

That said, there are already signs that economic activity is slowing down. Notably, consumer spending has been down for the last two months.

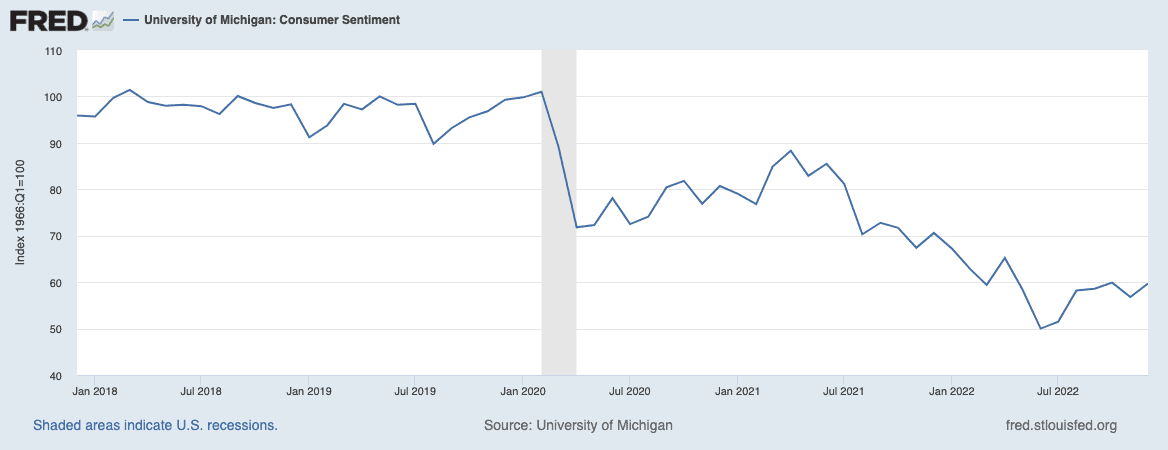

Declining consumer spending and sentiment

Consumer spending is the engine of the U.S. economy, as it makes up roughly 70% of the gross domestic product (GDP). After years of high inflation, a bad year for the stock market in 2022, and a lot of economic pessimism, it seems like Americans are cutting back on spending and bracing for difficult times ahead.

It’s worth mentioning that although consumer sentiment has rebounded slightly from summer 2022 lows, it is still extremely low. Meaning it’s not looking likely consumer spending will pick up anytime soon.

A puzzling labor market

The labor market is a puzzle right now, but there have been some major high-profile layoffs over the last several months. The tech sector has been hit particularly hard with companies like Amazon, Microsoft, Google, Netflix, Spotify, and many more laying off large swaths of highly paid employees. We’re also seeing layoffs in some financial and professional service sectors.

While these layoffs haven’t impacted the unemployment rate just yet, there is a general sense that this is just the tip of the iceberg, and more layoffs are forthcoming. Additionally, continuing unemployment claims (those who have been looking for work for a while) have ticked up modestly of late, indicating that it’s taking laid-off workers longer to find a new job. Of course, any significant increases in the unemployment rate would greatly increase the chances of a recession.

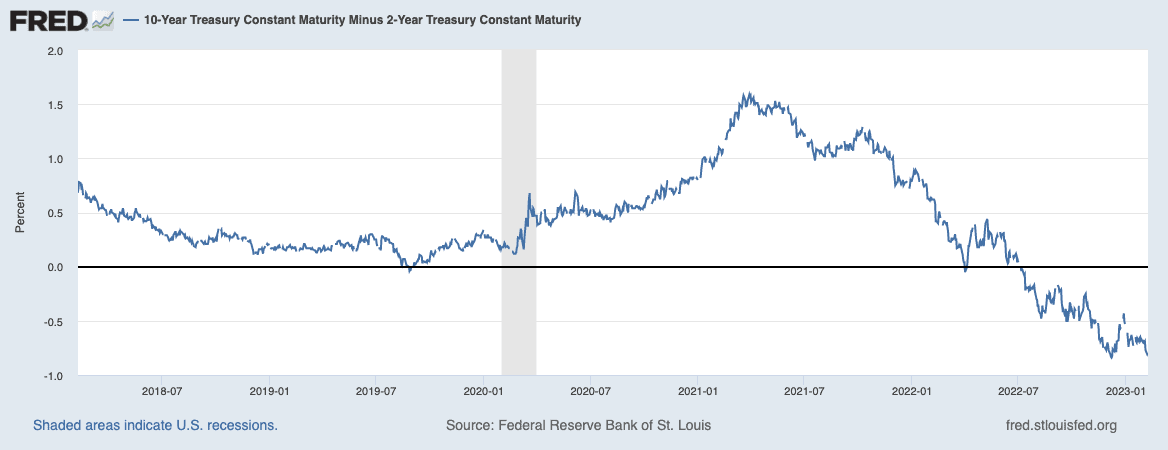

An inverted yield curve

Lastly, there is the yield curve, one of the most reliable predictors of a recession over the last 40 years. It predicted all but one recession accurately over that time. An inverted yield curve happens when long-dated U.S. Treasury bonds yield lower than short-dated bonds.

This is unusual because long-dated bonds usually offer higher yields due to the higher risk of inflation and default over a long period. The yield curve only inverts when investors are betting on a decline in long-term interest rates (due to an economic slowdown). We all know the Fed is currently raising interest rates, but the yield curve tells us that investors are betting that there will be a recession and the Fed will ultimately have to cut rates.

There are plenty of other economic signals that indicate a recession, but these are some of the clearest and most reliable datasets we have.

The Case for a Soft Landing

For months now, the Federal Reserve has been telling us that they are aiming for and believe a “soft landing” is possible. A soft landing basically means that the economy would cool off sufficiently to reduce inflation but not enough to cause a recession. As I wrote above, I thought this was pretty far-fetched a few months ago, but some data suggests a soft landing is still feasible.

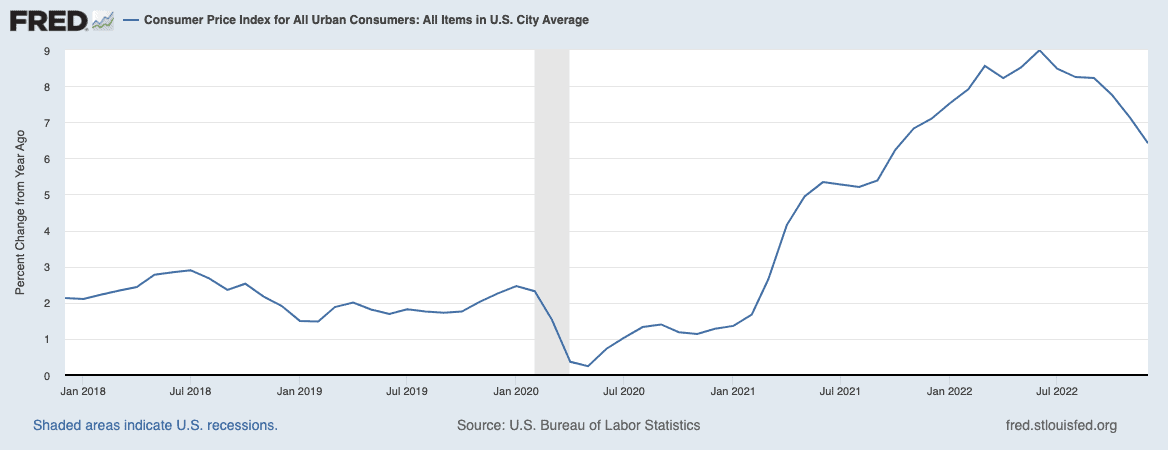

Declining inflation

First and foremost, inflation is declining, as I’ve written about extensively. It’s still very high (last reading at 6.4% year over year), but the downward trend is clear, and the monthly readings have been very encouraging of late.

Since the primary recessionary pressures on the economy are inflation and the Fed’s actions to tame inflation, any reduction in the inflation rate is positive news for the economy. If the Fed stops raising rates, it will remove a lot of uncertainty from the economy, which could help it stabilize.

A confusing but resilient labor market

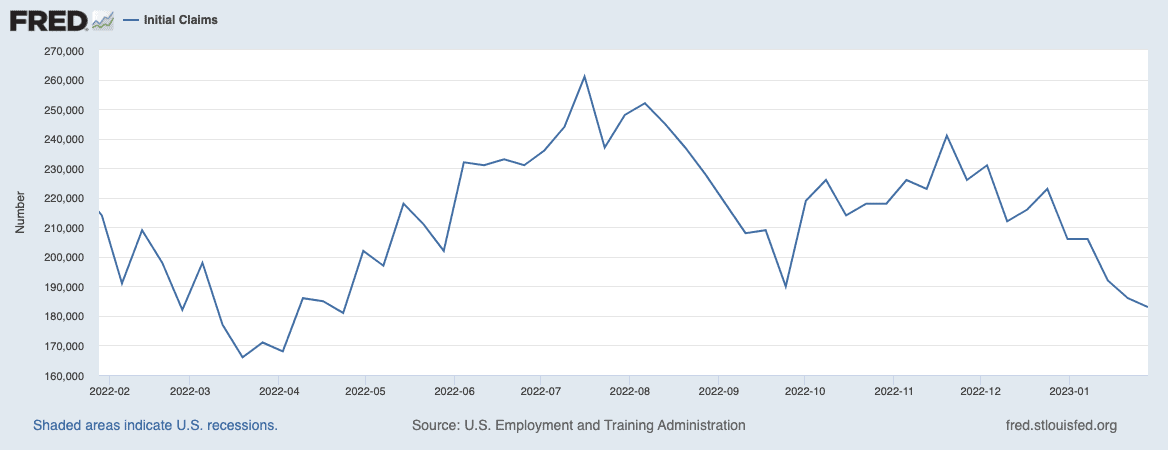

The second encouraging factor is the labor market. Yes, I know I wrote that the labor market is showing signs of recession, but it’s all showing signs of resilience. It’s very confusing. Despite the high-profile layoffs that are making headlines, there are signs the labor market is doing quite well. After rising over the summer, the number of initial jobless claims (people who claim unemployment benefits for the first time) has been ticking down over the last couple of weeks.

There are still over 10.5 million job openings in the U.S., which far outnumbers job seekers. As a result, the unemployment rate remains extremely low, at 3.5% (as of December 2022). Of course, there is a big question of whether the open jobs line up with the job seekers, and as I mentioned above, more layoffs could be around the corner. But whichever way you look at it, the labor market has shown tremendous resilience up to this point.

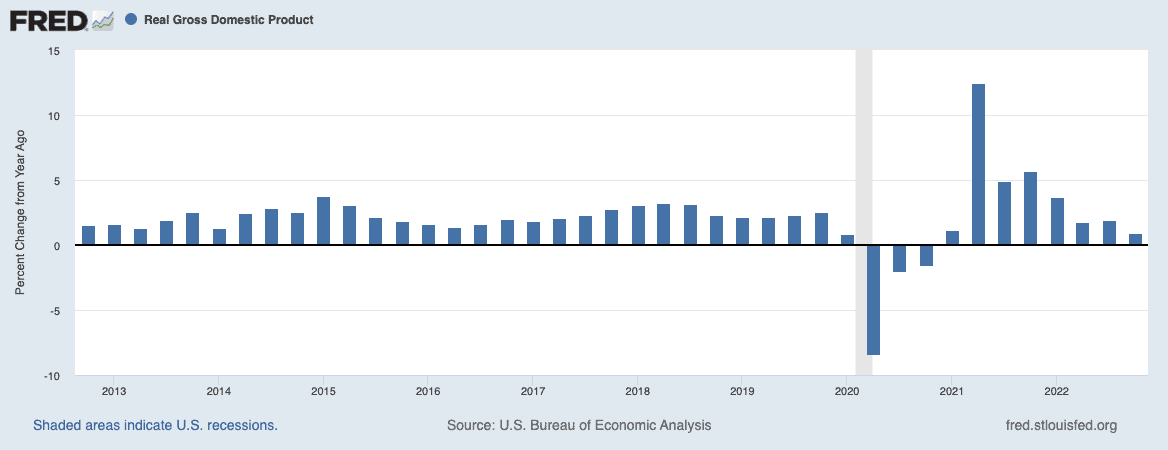

GDP growth

Lastly, GDP is growing, even in inflation-adjusted terms. Real GDP grew at a 2.9% annualized rate in Q4, which is basically the antithesis of a recession. The most commonly accepted definition of a recession is two consecutive quarters of GDP decline (even though that’s not technically how recessions are determined). By that measure, the U.S. is definitely not in a recession.

It’s worth noting that most economists calling for a recession in 2023 are saying it will come in the second half of the year, so GDP growth in Q4 of 2022 is not exactly surprising. That said, GDP growth is a good sign for the economy, in my opinion.

What Do The Experts Say?

Despite some relatively good economic news of late, over 70% of surveyed economists still believe a recession will occur, according to a Bloomberg poll. Every economist does have a different opinion. Still, the general consensus of those who believe there will be a recession is that we haven’t yet felt the full impact of high interest rates. We’ll see further declines in consumer spending and higher unemployment throughout 2023.

That said, even some detractors admit that a soft landing is feasible. Jason Draho, an economist and Head of Asset Allocation Americas for UBS Global Wealth Management, recently said, “The possibility of getting a soft landing is greater than the market believes. Inflation has now come down faster than some recently expected, and the labor market has held up better than expected.”

Mark Zandi of Moody’s Analytics recently coined the term “slowcession” to describe what he thinks will happen: a slowing of the economy to a near halt, but without actually going backward.

What Does This All Mean?

Of course, no one knows for sure what will happen over the coming year, but I think it’s increasingly likely that we will see a relatively modest outcome—either a soft landing with very minimal growth or a recession that isn’t too deep. We often like to look at things in black and white and say that it’s “recession or not,” when in reality, there are many shades of gray.

It’s likely we will land in a shade of gray.

Of course, things could change. There are many geopolitical risks, and if the labor market truly breaks or the stock market dives even further from here, there could be a deep recession.

For real estate investors, it’s important to know that economic slowdowns tend to come with lower mortgage rates. So while no one should be rooting for a recession, there is an interesting dynamic at play for real estate investors.

It’s often said that housing is “first in and first out” in a recession. Because real estate is a highly leveraged asset, during a rising interest rate environment, housing activity tends to slow down first. Housing makes up about 16% of GDP, so when housing slows, it can pull the rest of the economy into a recession. Once the economy is in a recession, interest rates tend to fall, making mortgages cheaper, and houses more affordable. This can lead to an uptick in buying among homeowners and real estate investors, and that uptick in housing activity can help pull the rest of the economy out of a recession. First one in, first one out.

We’re already starting to see this in some ways. Housing has slowed down over the last couple of months. Mortgage rates are down from where they were in November, but if we see a recession, they could come down even more. Combined with falling housing prices, this could create great buying opportunities that could pull the economy out of the recession.

Of course, this is just one scenario, but it’s the one I see as the most likely at this point.

More from BiggerPockets: 2023 State of Real Estate Investing

After years of unprecedented growth, the housing market has shifted course and has entered a correction. Now is your time to take advantage. Download the 2023 State of Real Estate Investing report written by Dave Meyer, to find out which strategies and tactics will profit in 2023.

What do you think will happen in 2023? Do you think we’ll see a soft landing? A recession? Or something in the middle. Let me know in the comments below.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

[ad_2]

Source link