[ad_1]

The big picture: As financial analyses summarizing 2022 keep rolling in, they continually spell bad news for tech hardware sales. The latest numbers from Jon Peddie Research paint a historically bad picture for desktop dedicated graphics cards. The fourth quarter improved from the previous quarter but fell significantly year-over-year.

Shipments of dedicated desktop graphics add-in-boards (AIB) returned to growth in Q4 2022 as Nvidia maintained its overwhelming market dominance. However, the quarter closed out what is likely the worst year for discreet GPUs on record.

The big GPU manufacturers and their partners shipped 7.3 million AIBs in the quarter ending December 31, 2022. That number represents a 7.8 percent increase from the 6.81 million moved in the prior quarter but a 27.4 percent year-over-year decline.

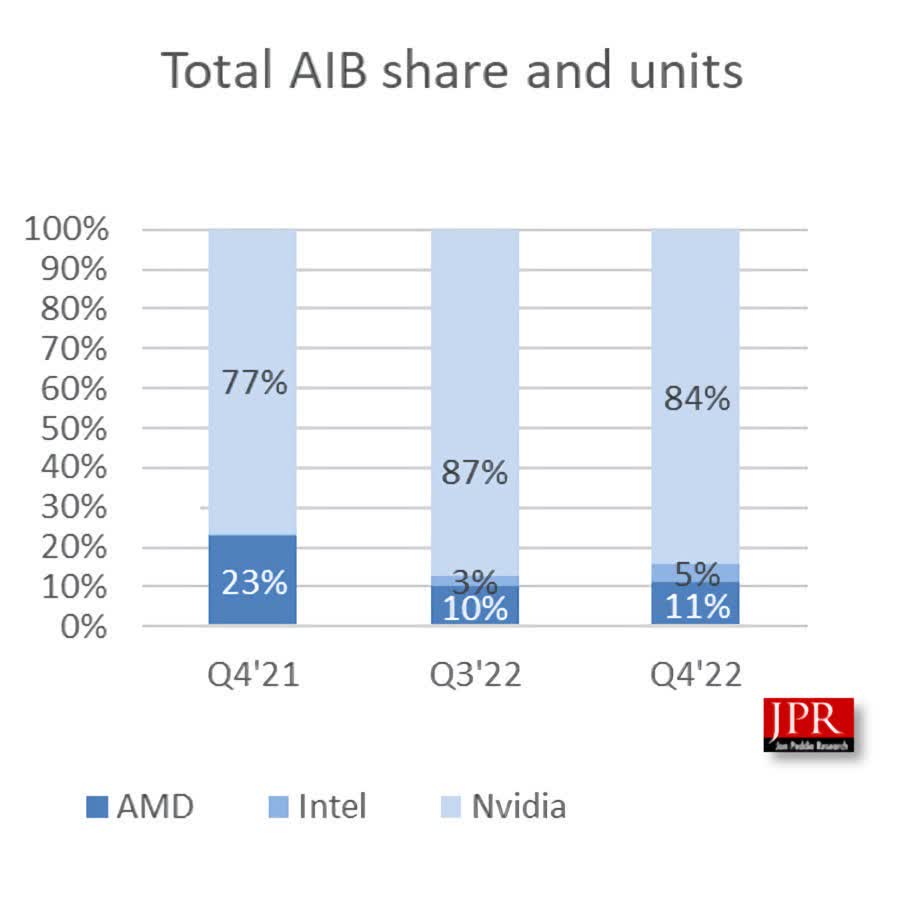

Team Red saw the most significant quarterly and annual swings in either direction. In Q4 2022, AMD shipped 21.2 percent more GPUs than in Q3 but 62.2 percent fewer than in Q4 2021. Nvidia saw a smaller quarter-to-quarter jump – just four percent – but also suffered a minor annual fall of 22 percent. More importantly, Team Green commanded 84 percent of the AIB market in Q4, while AMD increased its share to 11 percent, and Intel grabbed five percent.

Research group president Dr. Jon Peddie credited Nvidia’s flagship GeForce RTX 4090 with much of the quarterly growth despite its $1,600 MSRP. A JPR analyst said consistently low GPU stock indicates that enthusiasts are okay with high prices. Since AMD launched the Radeon RX 7800XT and 7800XTX at the very end of 2022, it’s unclear how much impact its flagship sales had in Q4.

The third quarter of 2022 was the worst for AIB shipments since 2005. The fourth was slightly better, still clocking in as the second poorest, cinching 2022 as the worst year on record for desktop dedicated graphics at around 38 million units. The all-time peak was the 116 million GPUs sold throughout 1998.

A deciding factor in the subpar numbers is likely the recent decline in desktop PC sales. Remote working in 2020 and 2021 caused a sales spike that mostly went to notebooks, with 2022 marked by a hangover affecting various sectors like DRAM, CPUs, notebook graphics, and much more.

Despite the dismal year, JPR expects the AIB market to expand by 7 percent over the next three years.

[ad_2]

Source link