[ad_1]

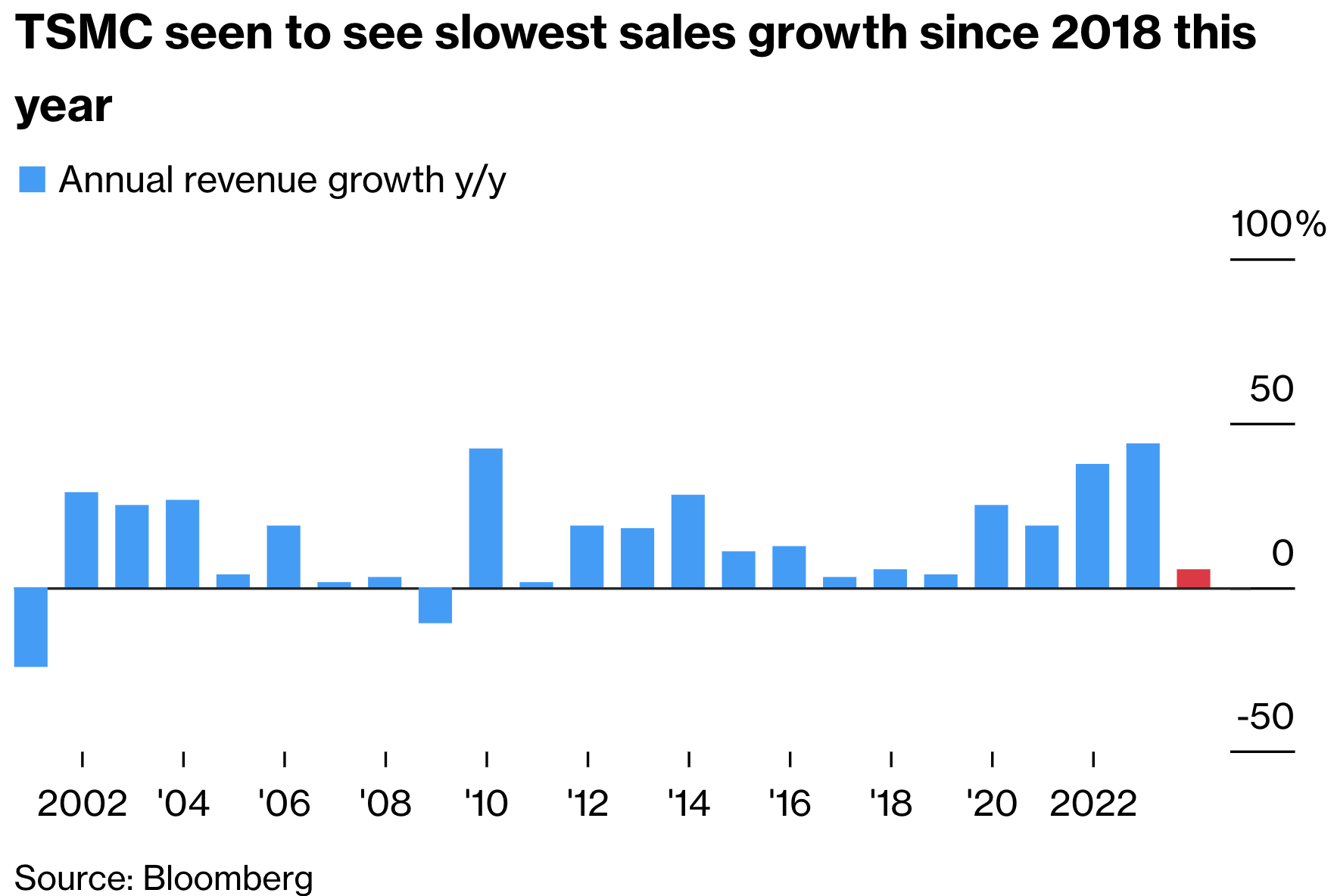

The big picture: As the chip shortage is slowly receding, companies like TSMC are starting to see their revenues drop for the first time in years. The general sentiment in the semiconductor industry is that things will get worse in the coming quarter before gradually improving towards the end of this year.

Last week, we learned that Samsung will be scaling back memory chip production in response to dwindling demand for DRAM and SSDs. Industry watchers certainly took notice when the world’s second-largest contract chipmaker warned investors that it wouldn’t make much profit until the excess supply of memory chips is reduced to “meaningful” levels.

The situation doesn’t look as dire for rival TSMC, which holds 56 percent of the overall semiconductor market. Still, the latest guidance figures suggest the Taiwanese company missed its sales targets for the first quarter of this year, which is yet another sign of weak demand for things like iPhones, game consoles, and PC components like Nvidia’s GeForce RTX 40-series graphics cards or AMD’s Ryzen 7000 series processors.

This would be the second quarter in a row of weak chip sales as consumers and businesses navigate the economic storm of surging inflation, rising interest rates, and bank collapses. For the first three months of 2023, TSMC estimates it has made sales totaling almost NT$ 509 billion ($16.7 billion), and this would represent a decline of over 16 percent compared to last quarter.

The average forecasted figure among analysts was NT$ 525.5 billion ($17.2 billion). When zooming in, we see that TSMC believes March was a particularly bad month where sales were down 15 percent year-over-year, whereas January and February saw a healthy boost. It would be the first drop in almost four years of constant revenue growth fueled by rising wafer prices and factories operating at full capacity.

Unlike Samsung, TSMC doesn’t see the need to reduce chip output. Instead, it will reduce its capital expenditure to anywhere from $32 billion to $36 billion. Both companies expect consumer interest in electronics to rebound in the second half of this year and don’t plan to reduce their investments in capacity expansions and more advanced fabrication tech.

Meanwhile, TSMC is trying to persuade the US government to consider changing the requirements for subsidies under the CHIPS Act. The company is investing $40 billion in a new plant in Arizona and wants to tap into a $52 billion fund for chip research and manufacturing without having to give away its corporate strategy or pay additional tax on excess profit.

[ad_2]

Source link