[ad_1]

The San Diego metropolitan area features a robust housing market—with some of the highest historical rent and price appreciation in the United States. Anchored by a growing economy, low unemployment, and a significant military presence, the San Diego real estate market offers investors a stable base with strong long-term growth prospects.

Economic Overview

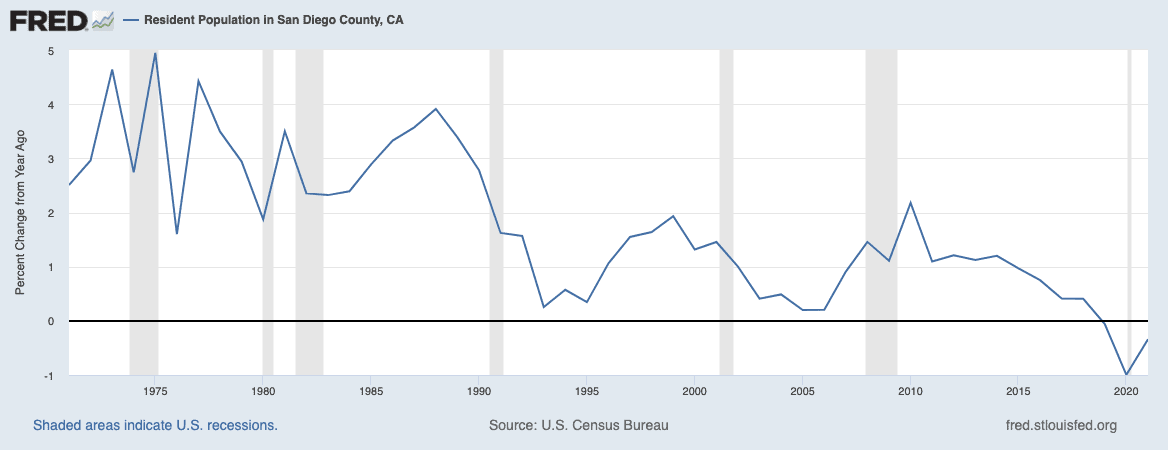

San Diego, located in Southern California, is the eighth largest metropolitan area in the United States, with a population of about 3.3M people. From 2010-2022, San Diego County grew nearly 7%, but recent estimates show a 0.4% decline in population from 2020-2021. For context, the state of California overall had an estimated decline of 0.8% during the same period.

Wages in San Diego are very high, with the median household income coming in at just above $82,000, compared to a national average of $65,000. Poverty rates are relatively low at 9.5% compared to the national average of 11.6%. These strong economic indicators are partially driven by a highly educated workforce, with nearly 40% of citizens holding a bachelor’s degree or higher.

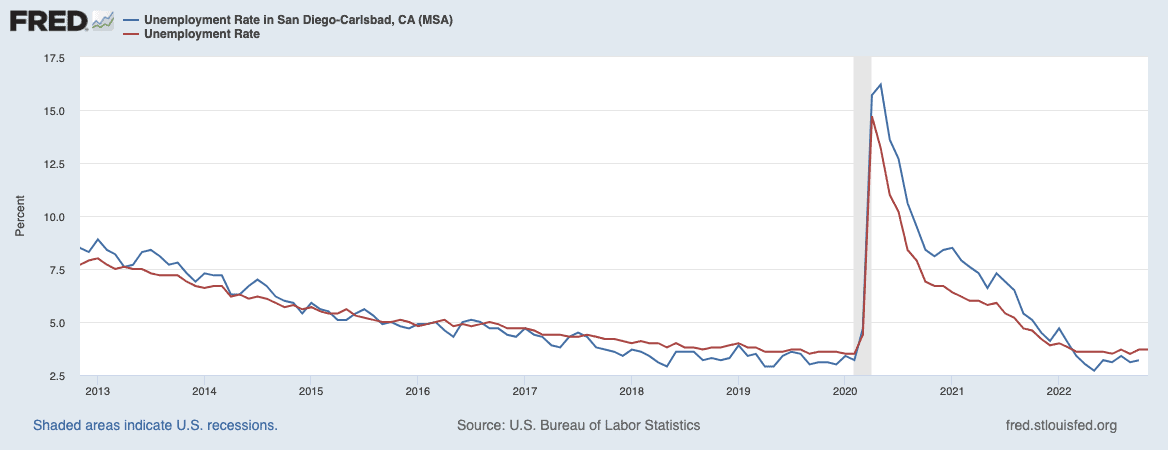

One of San Diego’s greatest strengths is its labor market. Unemployment rates remained solidly below the national average for many years pre-pandemic and have returned to very low lows in 2022.

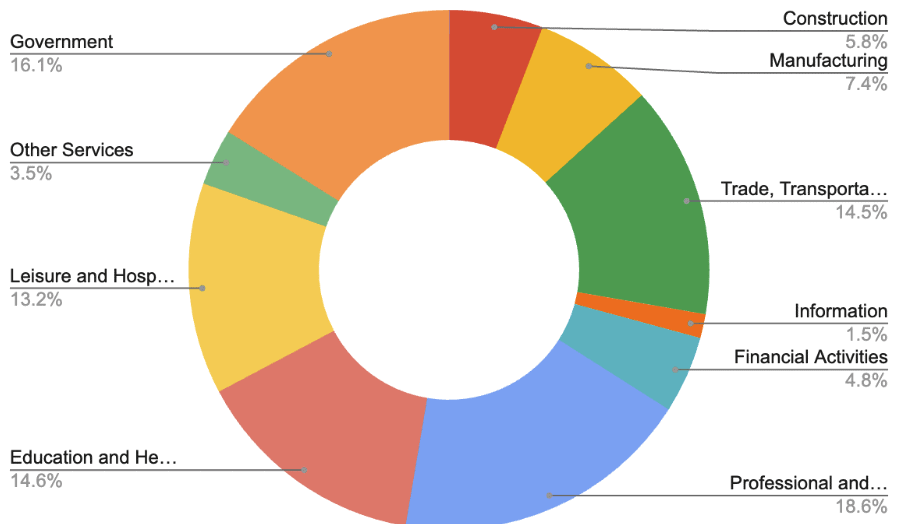

An important economic factor for real estate investors is the diversification of employment in a target market. When an area is highly dependent on one industry, it makes the market more susceptible to economic cycles. San Diego, however, has a well-diversified economy with a strong representation in education, hospitality, trade, professional services, and government.

Housing Prices

San Diego has a strong track record of property appreciation, growing a staggering 270% from the lows of the great recession in 2009 to current day, according to the S&P/Case-Shiller Index. As a result, San Diego has a relatively high entry point with a median sale price of almost $828,000 as of October 2022.

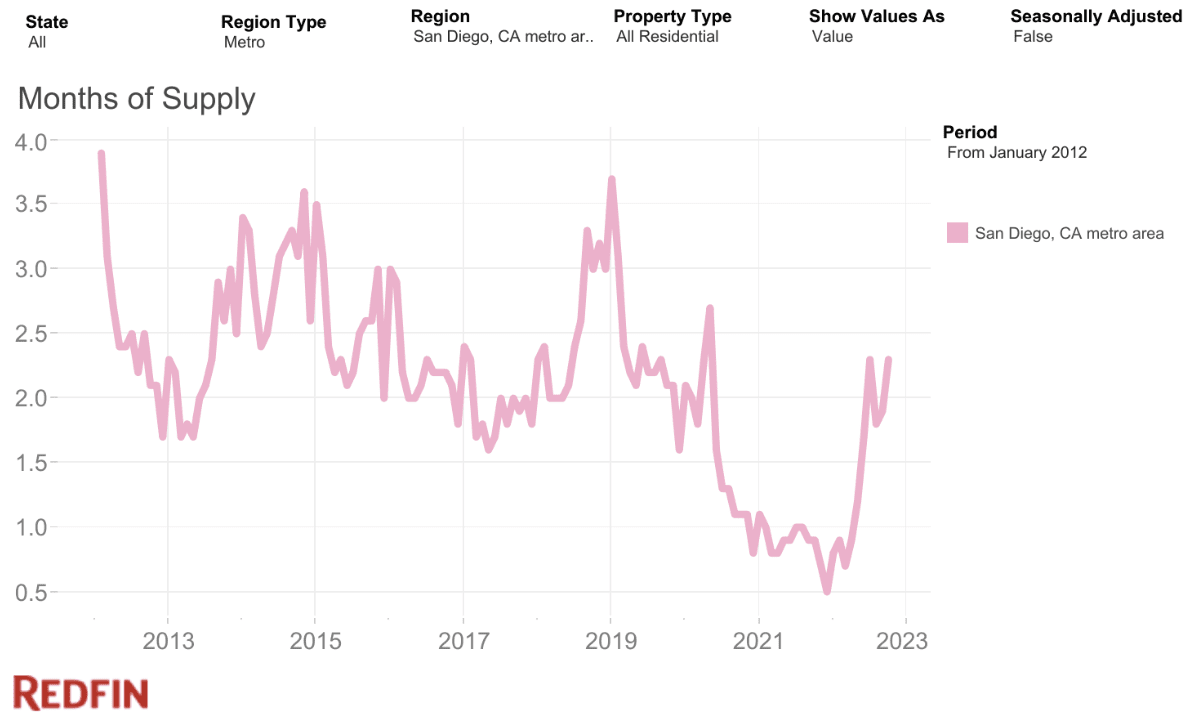

As with many markets, the San Diego market is showing signs of changing course. Since June, inventory (as measured by months of supply) has increased from pandemic lows and has started to level off near pre-pandemic averages.

This shift presents both opportunity and risk for real estate investors. With high-priced markets that appreciated rapidly during the pandemic, the risk of price corrections is considerable. It’s likely that prices will come down in San Diego in 2023.

However, increasing inventory and price declines mean that the San Diego market has shifted from a seller’s to a buyer’s market. When buyers have pricing power, they should focus on buying properties below asking price to insulate themselves against potential future price declines.

Rent Trends

For investors, one of the most attractive reasons to invest in San Diego is the strong rent growth. The median rent in San Diego is above $3,100 and has grown 10% in just the last year alone. While rent growth is starting to slow down, San Diego still has one of the country’s highest year-over-year rental growth rates. It’s a highly desirable place to live, and the demand for rental units is strong.

Find a San Diego Agent in Minutes

Connect with market expert David Greene and other investor-friendly agents who can help you find, analyze, and close your next deal:

- Search “San Diego”

- Enter your investment criteria

- Select David Greene or other agents you want to contact

Cash Flow Prospects

With potentially falling home values combined with high rents, cash flow prospects in San Diego are likely to increase in the coming months. That said, cash flow is relatively hard to come by as measured by the rent-to-price ratio (RTP).

Generally speaking, the higher the RTP, the better. Anything with an RTP close to 1% is considered an excellent area for cash flow, but it’s not a hard and fast rule. But that doesn’t mean cash flow cannot be found. There are good strategies for real estate investors to employ to generate excellent returns in San Diego.

Winning Strategies

According to David Greene, a local market expert, short-term rentals, medium-term rentals, and house hacking are all excellent ways to find cash flow in this market. Traditional buy-and-hold investing can still work but will likely require some value-add work to make the numbers pencil out.

If you can generate a good cash-on-cash return with some of the strategies mentioned above, San Diego could be a winning market for investors, given its reputation for great appreciation. Appreciation might slow down or reverse in 2023, but the long-term prospects remain very strong.

Getting Started: Invest in San Diego

To learn about investing in San Diego, partner with a local investor-friendly real estate agent like David Greene, who can help you find, analyze, and close the right deal.

Here’s how to contact David on Agent Finder. It’s easy:

- Search “San Diego”

- Enter your investment criteria

- Select David Greene or other agents you want to contact

David is a nationally recognized authority on real estate—he’s an agent, lender, investor, author, and co-host of the BiggerPockets Real Estate Podcast. He’s been featured on CNN, Forbes, HGTV, and more. David is the first to know which strategies work, when the market shifts, and the best areas for investing that will meet your goals.

Find an Agent in Minutes

Match with an investor-friendly real estate agent who can help you find, analyze, and close your next deal.

- Streamline your search.

- Tap into a trusted network.

- Leverage market and strategy expertise.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

[ad_2]

Source link