[ad_1]

By creating a balance sheet, companies reflect their financial situation at a specific point in time – usually at the end of a financial year. The balance sheet compares the use of funds / assets (assets) with the source of funds / liabilities (liabilities) . It provides information about how a company finances itself and how it uses its resources. Together with the profit and loss statement (P&L), the balance sheet can be used to draw conclusions about the economic situation of a company.

But who needs to prepare a balance sheet anyway? And how does this have to be structured? Why do both sides of the balance sheet have to be the same? Here you will find answers to these questions and instructions for creating your balance sheet in nine steps.

What purpose does a balance sheet serve?

A balance sheet is a snapshot, similar to a blood count. Thanks to its simple structure in the form of a T-account, it provides a quick overview of a company’s assets, equity and debt capital on a specific date. A balance sheet allows interested third parties such as investors, banks, business partners, shareholders and other third parties to see whether the company is on solid footing. It also serves as the basis for taxation by the tax office. In case of Power BI, view here financial reporting in power BI.

The balance sheet answers two important questions: Where do the resources with which a company works come from? And how are these funds used? Together with the income statement and possibly a management report, the balance sheet forms the annual financial statements of a company.

Who has to prepare a balance sheet?

Being subject to accounting requirements means that at least a balance sheet and a profit and loss statement must be prepared as part of the annual financial statements and, if necessary, supplemented by other documents. In principle, all traders and companies are obliged to keep double-entry books and therefore to balance sheets. However, exceptions and certain limits apply.

An overview of companies that are generally required to report:

- Traders, unless they are exempt from the accounting requirement due to their annual profits or sales

- Excluded are businesses with a profit of less than €60,000 or

- $600,000 turnover in the financial year.

- Farmers and foresters with independent trading businesses, unless they fall below the sales or profit limit applicable to traders

- Corporations and other companies (except for partner companies (PartG) and civil law companies (GbR)

- Merchants according to the Commercial Code, provided that the sales/profits do not fall below any legal limits

Freelancers are exempt from the accounting requirement. This means that you only have to submit simple accounting in the form of an income surplus statement (EÜR) to the tax office. However, you can do voluntary accounting. If you do this, you must also submit your balance sheet to the tax office.

Checklist for creating a balance sheet

Below you will find a checklist with the most important steps and documents needed to create a balance sheet. It doesn’t matter whether it is an interim balance sheet, annual balance sheet or special balance sheet.

As a rule, balance sheets are prepared at the end of a financial year, so we will focus on this case in the following instructions…

Recording of business transactions: All business transactions must be recorded in the accounting, e.g. Incoming and outgoing invoices, bank receipts and cash books. This part of accounting is also called “preparatory accounting”. In order to account correctly, all receipts must first be collected, digitized and account movements assigned.

Accounting and posting: The business transactions must be accounted and posted in order to record them in the corresponding accounts of the accounting system. With double-entry bookkeeping, you have to open asset and liability accounts – one account for each balance sheet item. As in the balance sheet, the assets side shows what assets are available in the item and the liabilities side shows where the assets come from – i.e. how they were financed.

Inventory: In order to determine the current value of a company’s assets and debts, an inventory must be carried out. These include, for example: B. Inventories of raw materials, goods, machinery, receivables and payables.

Closing of the financial year: All business transactions for the financial year must be recorded and accounted for. Business transactions that do not affect the business period to be closed must be separated accordingly.

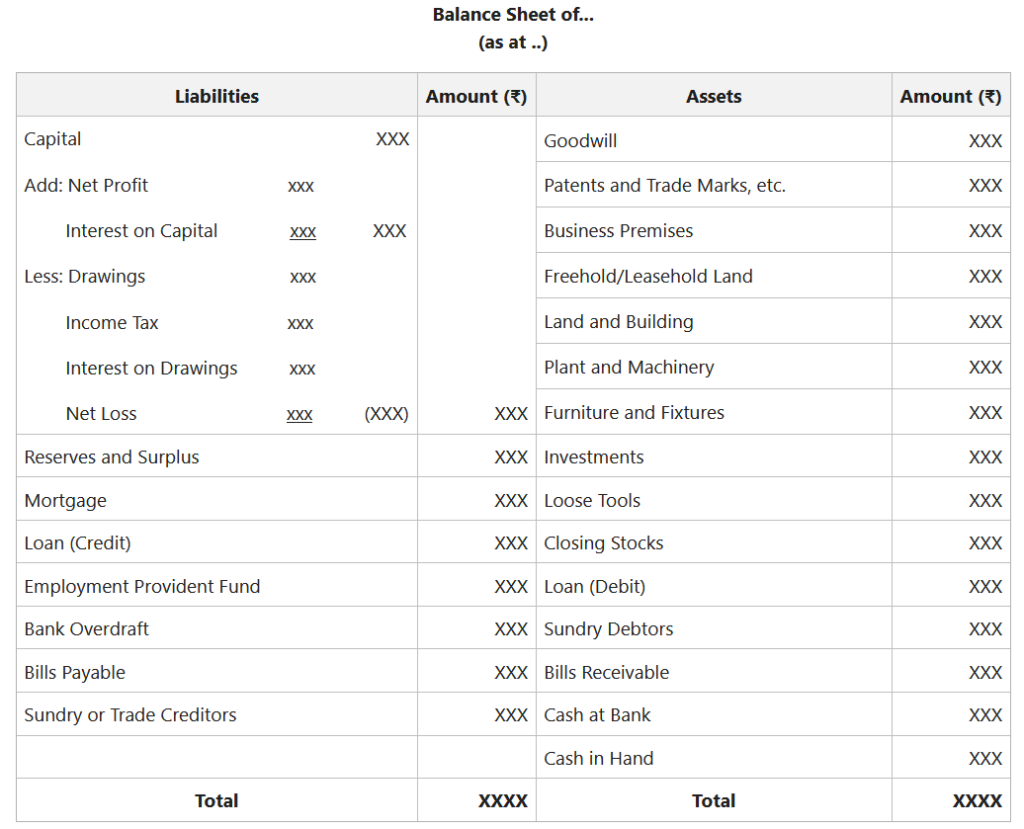

Balance sheet preparation: The balance sheet is prepared by comparing the assets and liabilities of the company. Both sides of the balance sheet – the assets and liabilities – must match. After the company’s assets have been determined and compared with the liabilities, the difference results in equity (EK). By determining the equity, the balance sheet equation is created – the balancing of assets and liabilities.

Verification and correction: The balance sheet is checked and, if necessary, corrected to ensure that it is complete and correct.

How should a balance sheet be structured?

The structure of a balance sheet is set out in Section 266 of the Commercial Code (HGB). If you use Acterys or another accounting tool, standardized charts of accounts have already been created that follow exactly this structure.

On the assets side

This is where a company’s assets are located – i.e. all the resources that a company owns and uses to achieve its goals. They are divided into:

Fixed assets: long-lived assets such as machinery, technical equipment, land and buildings

Current Assets: Current assets such as finished goods, work in progress, trade receivables, and cash.

On the liabilities side

A company’s liabilities and equity are listed here. This makes it clear how a company finances itself.

Equity: Equity is the portion of a company’s assets that is not financed by debt. It provides an overview of how much capital the company owns and how stable it is financially.

Current Liabilities: Debts that must be repaid within one year.

Long-term liabilities: Debts that will not have to be repaid for several years.

Balance sheet structure

Because most accounting companies are also obliged to disclose their annual reports, countless balance sheets can be found online. It can be worthwhile to take a look at the published balance sheets of other companies in your own industry. The direct comparison can set a benchmark for your own financial performance. For example, if your company performs significantly worse than comparable companies in terms of its debt-to-equity ratio, this can be a sign of possible financial risks.

A comparison with the balance sheets of previous years is also important in order to be able to read trends. That’s why balance sheets in the annual report are usually compared with the previous year’s results.

[ad_2]

Source link