[ad_1]

The residential real estate market is doing better than most had expected after interest rates more than doubled last year. Prices declined nationally each month from July 2022 to January 2023 (although never by more than 1% per month). However, prices came back up 0.2% in February. Ironically, February was the first month that prices dipped year-over-year, interrupting what was a record 131-month run of ever-increasing prices. It’s too early to say, but it appears that despite high rates, the residential market is stabilizing.

It’s not quite so pretty for commercial real estate, particularly office, though.

The Office Recession

Back in October of last year, I noted that “broadly speaking, the outlook for commercial real estate, specifically office buildings, is not great. And large office buildings, in particular, are doing poorly and will have difficulty in the coming years.” The reasons were threefold. First, the pandemic and lockdowns shuttered a lot of businesses, many permanently, and this led to a general deterioration of the existing stock and reduced demand for office space.

Second, work-from-home has become more prevalent in recent years, and Covid only accelerated that. One prominent economist even went so far as to say full-time office work is “dead.” While many companies are mandating employees return to the office, at least part of the time, the increase in work-from-home arrangements has obviously put downward pressure on the demand for office space.

Lastly, there’s been a notable increase in crime in many cities. While the issue of crime predominantly affects retail, it also hinders offices, particularly in downtown areas that employers tend to pay a premium for because of the popularity of those areas. As the popularity declines, so does that premium.

Still, it’s retail (discussed further below) that has been the hardest hit by crime, with many major retailers closing shop in various cities. Notably, Walmart has closed half its stores in Chicago and all its stores in Portland. Target announced it had sustained $400 million in losses due to shoplifting, and Walgreens has closed 10 locations in San Francisco.

And speaking of San Francisco, it has been hit particularly hard by all three of these trends. Office, in particular, has taken a beating, as this chart for office vacancies from The San Francisco Standard makes plainly evident.

This wasn’t hard to predict, as I noted last year, the way commercial leases are structured made this all but inevitable,

“The reason we can know for certain that this problem is going to get worse is the way commercial leases are structured. Unlike the typical lease on a home or apartment unit, commercial leases are usually 3-5 years long and sometimes more.

“Downtown commercial real estate was already declining before 2020, but the pandemic turbocharged that decline. Many of the firms that signed leases in 2017, 2018, and 2019 are stuck in those leases for a few more years. But all signs point toward a large number of them leaving after the end of their lease.

“So, if you think vacancy is high now, I’d recommend you buckle up.”

The trough of this office recession in San Francisco will likely take place in 2025 when 2 million square feet of office space will have its lease expire. (In 2023 and 2024, it is about 800,000 and 1.2 million, respectively.)

While San Francisco may have it the worst, office across the whole country has suffered. CBRE notes that “Q1 [of 2023] saw 16.5 million sq. ft. of negative net absorption” (italics mine). That is not exactly a positive sign.

This chart from Moody’s shows that after a brief and shallow recovery from the pandemic in 2021, office vacancy rates have again started to increase and are now near 20%, an increase of about 15% since the beginning of 2018. Furthermore, rent increases, having fallen dramatically during Covid before rising in 2021, are starting to move back toward zero while inflation is still high.

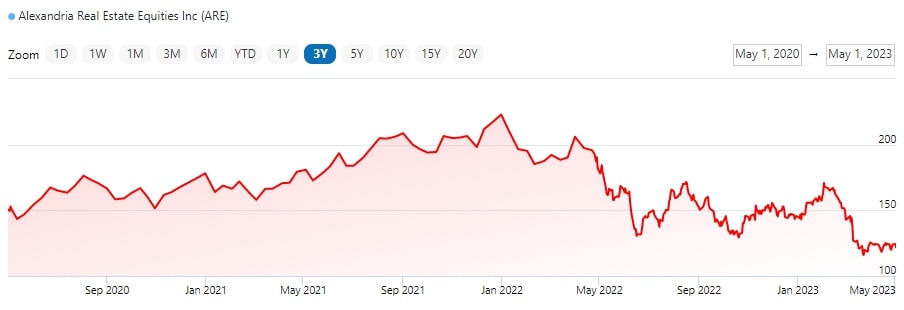

Perhaps another way to visualize this is by looking at how Alexandria Real Estate Equities, the biggest office REIT in the country by a factor of more than two, has performed in the last two years. Not well, to say the least. Its stock price has almost halved from a peak of $223 a share in December of 2021 to $124.18 at the time of this writing.

Other office REITs have performed similarly in the last year or two.

And unfortunately, this trend is likely to be with us for a while. Given how leases are structured and the hard reality that of the three factors driving this decline (the pandemic, work from home, and crime), the pandemic seems to be the only one that has ended or is likely to end soon. And given there is still a strong possibility of a recession later this year or in 2024, there isn’t much cause for optimism.

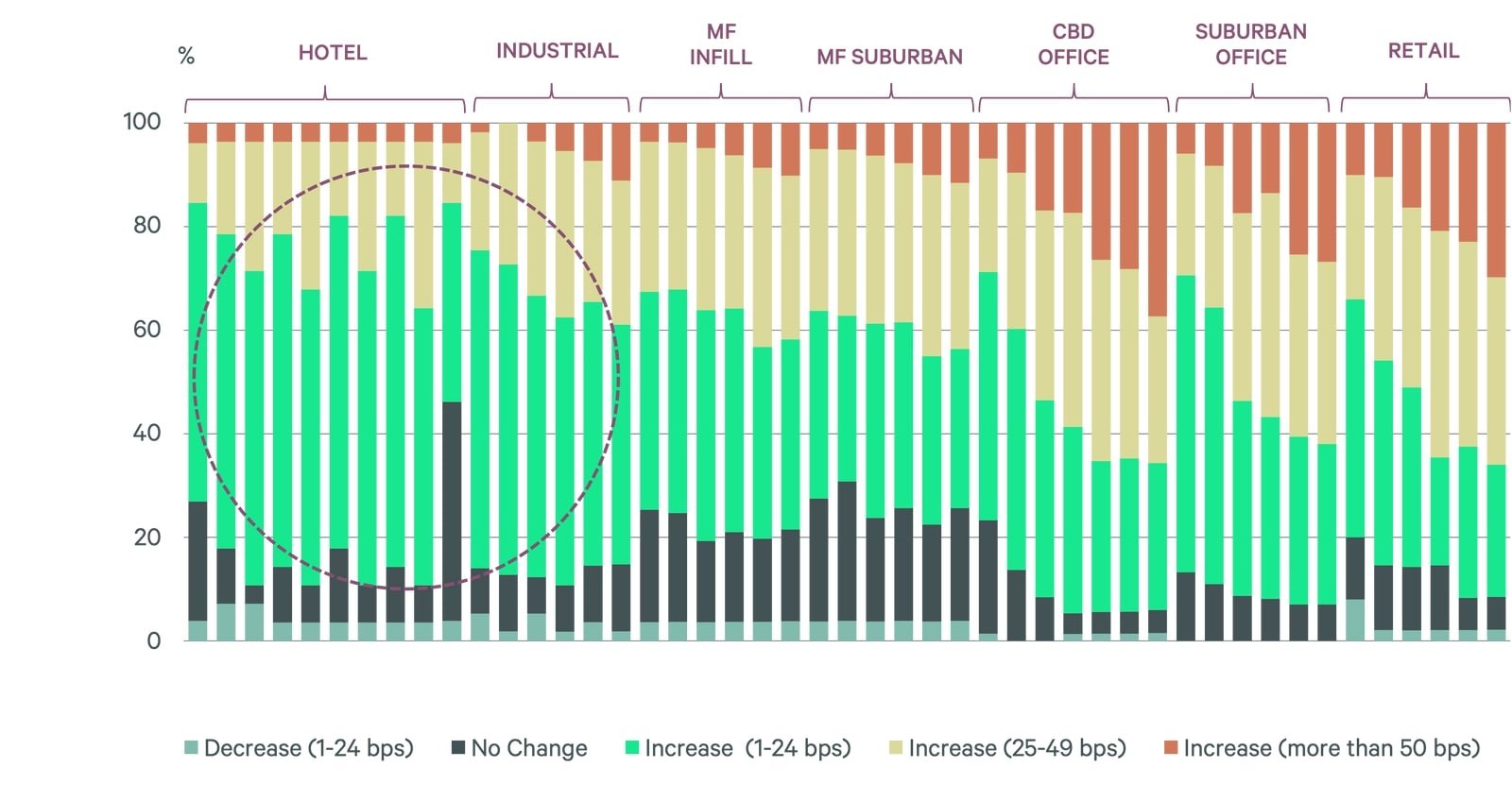

This situation can further be seen from a survey CBRE did early this year of 250 real estate professionals. Over half expect CBD office (central business district) and suburban office cap rates to increase 25 basis points or more (i.e., the price of such buildings will go down). And virtually no one expects cap rates to compress.

The only other sector with such a similarly bleak outlook is retail.

Is There a Retail Recession Too?

The pandemic is thankfully over, and retail is not something that can easily be done from home. Unfortunately, as noted earlier, crime problems affect retail the most. In addition, retail also has to worry about the Amazon problem. E-commerce as a percentage of total retail sales has grown from less than 5% in 2010 to 14% in 2020 and is projected to be 23.5% by 2025. Amazon accounts for over 40% of online retail sales.

Furthermore, inflation has pinched American pocketbooks and caused some to buy less. This can be hidden by raw sales reports because, for example, if you buy three widgets worth $10 one year and then next year, the widgets are $15, so you only buy two. Both years would still amount to $30 in sales. But inflation doesn’t necessarily mean that the profit margins are bigger on any given widget.

One survey found 72% of Americans reported “buying fewer items” when grocery shopping in 2022 as compared to 64% in 2021. Even still, retail sales (in terms of dollars spent) have fallen in four of the last five months and are mostly flat since early 2021.

Still, as far as vacancy rates go, retail is doing substantially better than office, albeit not great. It has recovered from the increase during Covid but settled in almost 50 basis points above where it was in 2018. Rents have been steadily increasing after major declines during Covid but still trail inflation substantially.

We can also look at the biggest retail REITs to get an idea of their relative performance. Realty Income Corp tops the chart here, and while 2022 and 2023 have not been kind to it, it’s only down about 15% from its peak in August of 2022 and just a bit over 20% since its pre-Covid peak, far better than Alexandria Real Estate Equities.

The Commercial Real Estate Recession

While residential real estate (including apartments) and industrial are doing okay despite the high interest rates, other sectors have not been nearly as fortunate.

While we appear to be in a shallow recession for retail, office has taken a beating.

The long-term future looks questionable for retail as Amazon and other e-commerce firms continue to eat into the share of brick-and-mortar establishments. At least in the present, though, retail appears to be stabilizing somewhat.

Office properties, however, are a different story. The situation for such properties is dire and getting worse. And it will likely be some time before such trends reverse.

Find an Elite Agent in Minutes

Use Agent Finder to connect with local market experts like Victor Steffen, Kim Meredith-Hampton, and Matthew Nicklin.

- Search target markets like Dallas, Tampa, or Atlanta

- Enter investment criteria

- Select investor-friendly agents that fit your needs

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

[ad_2]

Source link